| Kurse | Charts | Stammdaten | Kennzahlen | Aktion |

|---|---|---|---|---|

| Snapshot | Preischart | Daten + Gebühr | Performance | Portfolio |

| Börsenplätze | Performance | Management | Volatilität | Watchlist |

| Historisch | Benchmark | Sharpe Ratio | ||

| Rendite | Ratings |

Kurse

Charts

Stammdaten

Kennzahlen

Nettoinventarwert (NAV)

| 145.57 NOK | 0.06 NOK | 0.04 % |

|---|

| Vortag | 145.51 NOK | Datum | 23.01.2025 |

Anzeige

| Name | ISIN | Performance | |

|---|---|---|---|

| 21Shares Ripple XRP ETP | CH0454664043 | 491.70% | |

| 21Shares Stellar ETP | CH1109575535 | 352.33% | |

| 21Shares Algorand ETP | CH1146882316 | 241.42% | |

| 21Shares Stacks Staking ETP | CH1258969042 | 227.84% | |

| 21Shares Cardano ETP | CH1102728750 | 179.10% | |

| 21Shares Sui Staking ETP | CH1360612159 | 129.64% | |

| 21Shares Injective Staking ETP | CH1360612134 | -1.13% | |

| 21Shares Immutable ETP | CH1360612142 | -20.47% |

| Name | ISIN | Performance | |

|---|---|---|---|

| 21Shares Sui Staking ETP | CH1360612159 | 425.62% | |

| 21Shares Ripple XRP ETP | CH0454664043 | 413.73% | |

| 21Shares Stellar ETP | CH1109575535 | 311.72% | |

| 21Shares Aave ETP | CH1135202120 | 246.50% | |

| 21Shares Algorand ETP | CH1146882316 | 176.60% | |

| 21Shares Stacks Staking ETP | CH1258969042 | 145.10% | |

| 21Shares Injective Staking ETP | CH1360612134 | -20.51% | |

| 21Shares Immutable ETP | CH1360612142 | -23.45% |

| Name | ISIN | Performance | |

|---|---|---|---|

| 21Shares Ripple XRP ETP | CH0454664043 | 499.37% | |

| 21Shares Stellar ETP | CH1109575535 | 282.07% | |

| 21Shares Aave ETP | CH1135202120 | 278.62% | |

| 21Shares Crypto Basket Equal Weight (HODLV) ETP | CH1135202161 | 250.09% | |

| 21Shares Solana staking ETP | CH1114873776 | 208.68% |

| Name | ISIN | Performance | |

|---|---|---|---|

| 21Shares Solana staking ETP | CH1114873776 | 970.95% | |

| 21Shares Ripple XRP ETP | CH0454664043 | 608.15% | |

| 21Shares Crypto Basket Equal Weight (HODLV) ETP | CH1135202161 | 364.59% | |

| 21Shares Bitcoin Core ETP | CH1199067674 | 358.47% | |

| 21Shares Bitcoin ETP | CH0454664001 | 346.87% |

Fundamentaldaten

| Valor | 34144216 |

| ISIN | LU1499703715 |

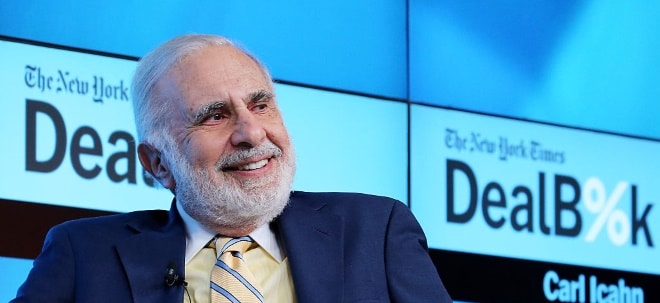

| Emittent | Capital Four AIFM A/S |

| Aufgelegt in | Luxembourg |

| Auflagedatum | 03.10.2016 |

| Kategorie | Anleihen Sonstige |

| Währung | NOK |

| Volumen | 729’401’317.27 |

| Depotbank | Bank of New York Mellon S.A./N.V. |

| Geschäftsjahresende | 31.12. |

| Berichtsstand | 09.01.2025 |

Anlagepolitik

So investiert der Capital Four Invest European Loan & Bond Fund E Fonds: The Sub-Fund C’s Investment Policy is based on credit markets. Credit markets offer attractive investment opportunities based on a cyclical perspective (high spreads) and based on systemic factors: – Increased risk awareness; – Reduced activity from traditional buyers of credit assets; and – Continuing high supply from refinancing activities. The Sub-Fund C’s investment strategy is based on detailed fundamental analysis and careful portfolio construction and risk management. Structured Products: The Sub-Fund C may invest a maximum of 20% of its Invested Assets in asset backed securities (ABS’s), including collateralised loan obligations (CLO’s), collateralised mortgage obligations (CMO’s), collateralised debt obligations (CDO’s) and credit default swaps (CDS’s);

ETP Performance: Capital Four Invest European Loan & Bond Fund E Fonds

| Performance 1 Jahr | 7.67 | |

| Performance 2 Jahre | 19.32 | |

| Performance 3 Jahre | 16.10 | |

| Performance 5 Jahre | 24.95 | |

| Performance 10 Jahre | - |