| Kurse | Charts | Stammdaten | Kennzahlen | Aktion |

|---|---|---|---|---|

| Snapshot | Preischart | Daten + Gebühr | Performance | Portfolio |

| Börsenplätze | Performance | Management | Volatilität | Watchlist |

| Historisch | Benchmark | Sharpe Ratio | ||

| Rendite | Ratings |

Kurse

Charts

Stammdaten

Kennzahlen

Nettoinventarwert (NAV)

| 1’099.17 EUR | 0.16 EUR | 0.01 % |

|---|

| Vortag | 1’099.01 EUR | Datum | 22.01.2025 |

Anzeige

| Name | ISIN | Performance | |

|---|---|---|---|

| 21Shares Ripple XRP ETP | CH0454664043 | 491.70% | |

| 21Shares Stellar ETP | CH1109575535 | 352.33% | |

| 21Shares Algorand ETP | CH1146882316 | 241.42% | |

| 21Shares Stacks Staking ETP | CH1258969042 | 227.84% | |

| 21Shares Cardano ETP | CH1102728750 | 179.10% | |

| 21Shares Sui Staking ETP | CH1360612159 | 129.64% | |

| 21Shares Injective Staking ETP | CH1360612134 | -1.13% | |

| 21Shares Immutable ETP | CH1360612142 | -20.47% |

| Name | ISIN | Performance | |

|---|---|---|---|

| 21Shares Sui Staking ETP | CH1360612159 | 425.62% | |

| 21Shares Ripple XRP ETP | CH0454664043 | 413.73% | |

| 21Shares Stellar ETP | CH1109575535 | 311.72% | |

| 21Shares Aave ETP | CH1135202120 | 246.50% | |

| 21Shares Algorand ETP | CH1146882316 | 176.60% | |

| 21Shares Stacks Staking ETP | CH1258969042 | 145.10% | |

| 21Shares Injective Staking ETP | CH1360612134 | -20.51% | |

| 21Shares Immutable ETP | CH1360612142 | -23.45% |

| Name | ISIN | Performance | |

|---|---|---|---|

| 21Shares Ripple XRP ETP | CH0454664043 | 499.37% | |

| 21Shares Stellar ETP | CH1109575535 | 282.07% | |

| 21Shares Aave ETP | CH1135202120 | 278.62% | |

| 21Shares Crypto Basket Equal Weight (HODLV) ETP | CH1135202161 | 250.09% | |

| 21Shares Solana staking ETP | CH1114873776 | 208.68% |

| Name | ISIN | Performance | |

|---|---|---|---|

| 21Shares Solana staking ETP | CH1114873776 | 970.95% | |

| 21Shares Ripple XRP ETP | CH0454664043 | 608.15% | |

| 21Shares Crypto Basket Equal Weight (HODLV) ETP | CH1135202161 | 364.59% | |

| 21Shares Bitcoin Core ETP | CH1199067674 | 358.47% | |

| 21Shares Bitcoin ETP | CH0454664001 | 346.87% |

Fundamentaldaten

| Valor | 34050293 |

| ISIN | LU1498485504 |

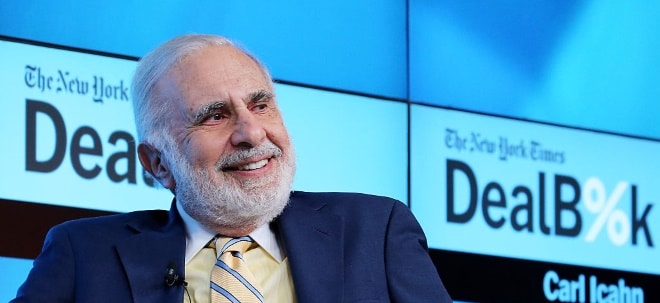

| Emittent | Sumus Capital |

| Aufgelegt in | Luxembourg |

| Auflagedatum | 14.10.2016 |

| Kategorie | Anleihen Sonstige |

| Währung | EUR |

| Volumen | 14’181’810.66 |

| Depotbank | CACEIS Bank, Luxembourg Branch |

| Geschäftsjahresende | 30.09. |

| Berichtsstand | 23.01.2025 |

Anlagepolitik

So investiert der SUMUS - Crossover Bonds Fund Class Premium EUR Fonds: The target is to reach, over the long term, and for performance measurement only, a return of US Generic Government 1 month yield + 250 bps. The main source of the return will result from security selection and asset allocation decisions on different sectors and countries in the fixed income markets. The global approach of the Sub-Fund is to be flexible and benchmark-agnostic, i.e. the Investment Manager will actively manage the Sub-Fund without reference to a benchmark and will principally allocate assets on the basis of the risk-return profile of each potential investment and on the correlation with the other investments in the portfolio.

ETP Performance: SUMUS - Crossover Bonds Fund Class Premium EUR Fonds

| Performance 1 Jahr | 5.14 | |

| Performance 2 Jahre | 11.01 | |

| Performance 3 Jahre | 1.10 | |

| Performance 5 Jahre | 1.13 | |

| Performance 10 Jahre | - |