|

11.11.2024 13:56:26

|

AMINA Bank: Winds of Change: Bitcoin in the New US Era

Crypto-related stocks surged ahead of the broader market. Coinbase, one of the largest cryptocurrency exchanges, saw shares rise by 17%. Robinhood Markets, which facilitates crypto trading, jumped 12%, while MicroStrategy - a major corporate Bitcoin holder - increased by 10%.

Today’s Crypto Market Monitor explores what Trump’s victory could mean for the broader cryptocurrency market and offers a glimpse into the industry’s likely trajectory.

Promises made

Ahead of the election, both Republican and Democratic leaders promised to create a more supportive regulatory framework for the cryptocurrency sector, a topic we covered in earlier issues of Crypto Market Monitor. Now that Republicans are set to take office, let's review some of their key proposals that could impact the crypto market during Trump’s second term.

Backing for Bitcoin Mining in the US

In June, Trump expressed strong support for Bitcoin mining, even stating he wanted "all remaining Bitcoin mined within the USA." This position signals a likely push for pro-Bitcoin regulations, potentially solidifying the US’s stance as a key player in global crypto.

Bitcoin as a National Reserve Asset

In July, Senator Cynthia Lummis proposed the BITCOIN Act of 2024 (Boosting Innovation, Technology, and Competitiveness through Optimized Investment Nationwide Act), urging the US Treasury to acquire 1 million BTC to help shield the dollar from devaluation. Following Trump’s win, Lummis reaffirmed this plan. This move, while focused on strengthening the dollar, would also position Bitcoin firmly as a blue-chip asset.

Simplified Tax Code for Digital Assets

Although not a formal campaign promise, Trump’s commitment to tax reform has led some in the Bitcoin community to anticipate policies that would ease digital asset tax obligations.

Donald Trump’s recent campaign stands out as the first presidential run to give crypto such a prominent role. Trump’s tech-focused, crypto-friendly inner circle adds further weight to this. Among them is Elon Musk, whose companies Tesla and SpaceX hold over 17,500 BTC combined, and Vice President-elect JD Vance, who is known to have a substantial personal BTC holding.

In another recent development, Strive Asset Management, founded by former 2024 Republican candidate Vivek Ramaswamy, launched a Bitcoin-integrated wealth management division. Perhaps most significantly, Trump has vowed to replace SEC chair Gary Gensler, who has actively pursued litigation against various crypto projects for potential securities law breaches.

Although Gensler’s term doesn’t end until 2026, the rumour mills speculate that he might step down when Trump assumes office, as SEC chairs often do when the appointing president leaves. This shift in SEC leadership could pave the way for more crypto products to enter mainstream markets.

Altogether, these factors are sparking discussions on what the Trump administration might bring for crypto. A very likely scenario sees the US shifting from regulatory uncertainty to a crypto-supportive environment, incorporating Bitcoin more deeply and driving broader adoption. This shift could lead to higher demand for Bitcoin as a store of value and investment asset, driving optimism around cryptocurrencies.

Spotlight on Polymarket

During this election, prediction markets outperformed traditional polls in both speed and accuracy, effectively gauging public opinion and predicting outcomes. Polymarket, a prediction market platform on the Polygon blockchain, emerged as a standout.

Participants on Polymarket placed bets on state results, reflecting changing sentiments. According to Dune, users wagered over $2 billion on the presidential race in recent months. Interestingly, Polymarket users regularly anticipated state results 2-8 hours before media outlets announced them.

Figure 1: Some examples of Polymarket predicting election outcomes for states sooner than AP News

Source: X

Polymarket’s election predictions matched actual results closely, prompting a lively discussion on X about the reliability of prediction markets for real-life events.

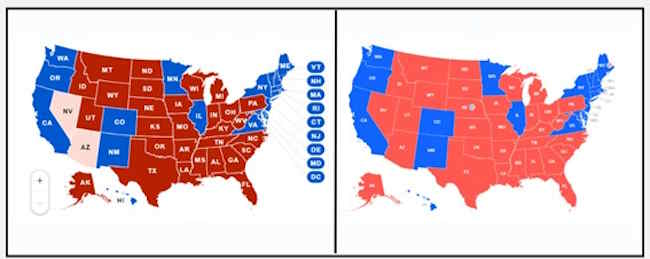

Figure 2: Actual election results (left) vs as predicted on Polymarket (right)

Source: Google.com, Polymarket

Advocates argued that prediction markets could offer greater accuracy than polls, tapping into the collective knowledge of participants with money on the line. Many, however, contended that prediction markets remain too volatile, influenced heavily by personal sentiment and hype.

The way ahead

Cryptocurrency prices are highly sensitive to geopolitical events and broader economic shifts. Moreover, Trump’s genuine commitment to supporting the industry has yet to be fully tested.

Regulations have always been a huge hurdle in the way of wider acceptance of digital assets. However, encouraging signs are visible. Stand With Crypto reports a strong showing of pro-crypto representation in Congress, with 247 supportive candidates elected to the House and 15 to the Senate.

This Congress is poised to be the most pro-crypto in history. Still, like any transformative technology, crypto’s long-term success will rely on consistent bipartisan support. With a shift in the government’s friendliness towards the industry, the future of the underlying technology and its use in financial and nonfinancial industry is starting to shine brighter.

BITCOIN KAUFEN? DAS SOLLTEN SIE JETZT WISSEN!

Was beim Einstieg wirklich zählt: Sichere Handelsplätze finden, wichtige Grundlagen und aktuelle Trends verstehen.

Jetzt informieren und fundiert in Bitcoin investierenTop Kryptowährungen

| Bitcoin | 71’793.04316 | -3.09% | Handeln |

| Vision | 0.07346 | -4.10% | Handeln |

| Ethereum | 2’436.25086 | -3.31% | Handeln |

| Ripple | 1.63609 | -2.96% | Handeln |

| Solana | 106.73698 | -4.49% | Handeln |

| Cardano | 0.33462 | -5.27% | Handeln |

| Polkadot | 1.70826 | -6.55% | Handeln |

| Chainlink | 10.94185 | -4.51% | Handeln |

| Pepe | 0.00000 | -7.90% | Handeln |

| Bonk | 0.00001 | -6.06% | Handeln |

Inside Krypto

Ob Industrie 4.0, Luxusgüter oder Internet-Infrastruktur - hier finden Sie aktuelle Anlagetrends mit vielen Hintergrundinformationen und passenden Trendaktien. Jetzt mehr lesen

Börsentag 2025: Silber vor Verdopplung? Rohstoffexperte über die Chancen

Im Experteninterview erklärt Prof. Dr. Torsten Dennin, welche Faktoren die Preise von Gold, Silber, Kupfer, Uran und Agrarrohstoffen treiben – und welche Chancen & Risiken Anleger jetzt kennen sollten.

👉 Was steckt hinter der aktuellen Gold- und Silber-Rallye?

👉 Welche Rohstoffe gelten 2025 als besonders spannend für Investments?

👉 Wie investieren Anlegerinnen und Anleger am besten in Edelmetalle & Rohstoffe?

Erhalte fundierte Einschätzungen, Marktprognosen und Antworten auf spannende Zuschauerfragen rund um Edelmetalle, Minenaktien, ETFs und Rohstofftrends.

👉🏽 Jetzt auch auf BXplus anmelden und von exklusiven Inhalten rund um Investment & Trading profitieren!