|

03.01.2025 13:24:43

|

AMINA Bank: Milestones That Mattered: Crypto's Journey in 2024

As we prepare for the opportunities that 2025 holds for the crypto market, it’s the perfect time to reflect on an extraordinary year for the industry. In this edition of the Crypto Market Monitor, we revisit 2024 - a year shaped by pivotal events, meaningful milestones and transformative trends. After all, a year is a lifetime in crypto!

The Restaking Narrative

The Ethereum restaking narrative took centre stage in the altcoin market during Q1 2024. EigenLayer pioneered ETH restaking, driving the sector's popularity to new heights. By the end of 2024, the total value locked (TVL) in restaking decentralised applications had surged by over 1800%, climbing from $1.34 billion to more than $24.71 billion.

The first major spike in this growth occurred on February 6, when EigenLayer temporarily lifted its staking cap of 200K ETH per protocol. This move led to a nearly 250% increase in EigenLayer's TVL, pushing it to $5.7 billion. Over the following months, TVL across restaking protocols continued to rise steadily, underscoring the growing demand for staking yield opportunities.

While the majority of restaking activity was Ethereum-centric, with a focus on ETH, Babylon disrupted the space by introducing Bitcoin restaking in early October. Despite its late entry in Q4, Babylon quickly climbed to the second position by TVL and currently holds $5.44 billion-equivalent to 36.32% of EigenLayer’s TVL.

Nevertheless, 2024 was defined by EigenLayer's overwhelming dominance. At its peak TVL of $20.12 billion, EigenLayer commanded a 94% share of the restaking sector, well ahead of competitors like Karak (4.9%) and Parasail (3%).

Figure 1: Growth of TVL across the top 10 restaking protocols in 2024

Source: DefiLlama

Approval of Spot ETFs

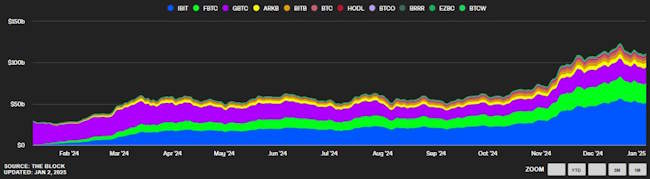

Arguably the most important crypto event of 2024 was the approval of 11 spot Bitcoin ETFs in the United States - a milestone eagerly awaited since rumours began circulating in early 2023. By October of that year, these rumours gained credibility as prominent financial institutions, including BlackRock, filed applications for spot Bitcoin ETFs. The approvals came through in early January 2024, with the first trades taking place on January 11.

As of now, the total assets under management (AUM) for US spot Bitcoin ETFs stand at $110 billion, reflecting a remarkable 383% growth since their launch. This development not only signified a new era for Bitcoin adoption but also marked a historic first in the crypto market cycle. For the first time, Bitcoin's price exceeded its previous all-time high (ATH) ahead of the Halving event.

Figure 2: US Spot Bitcoin ETF AUM

Source: The Block

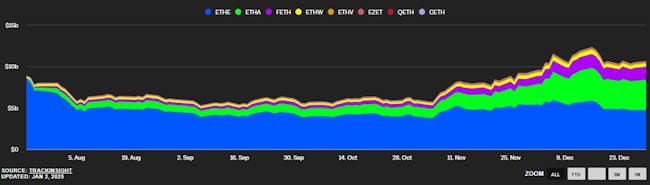

Another pivotal moment for the crypto market was the approval and listing of spot Ether ETFs. In November 2023, financial giants BlackRock and Fidelity submitted applications to the US SEC to launch the first spot Ethereum ETFs. These applications received approval in May 2024, with trading beginning on July 23.

Despite high expectations driven by the success of Bitcoin ETFs, Ethereum ETFs initially struggled to gain traction. Their popularity remained relatively subdued for much of the year until a surge in interest following Donald Trump’s election victory later in 2024. Currently, the total assets under management (AUM) for US spot Ether ETFs stand at $10.63 billion, reflecting a more modest uptake compared to it's Bitcoin counterparts.

Figure 3: US Spot Ethereum ETF AUM

Source: The Block

Bitcoin's Fourth Halving

Bitcoin experienced its fourth Halving in April 2024, reducing miner rewards from 6.5 BTC to 3.125 BTC per block. Historically, Bitcoin Halvings have been associated with significant price surges, but this year saw a brief dip, with BTC reaching a local bottom of $54,000.This decline was largely attributed to the Halving acting as a "sell-the-news" event, following Bitcoin's meteoric rise in the wake of US spot ETF approvals earlier. However, the market quickly shifted as growing anticipation of US Federal Reserve rate cuts sparked renewed optimism. Additionally, the possibility of a pro-crypto Donald Trump administration in 2025 further buoyed market sentiment, driving Bitcoin and the broader crypto market to new highs.

Trump Wins the US Presidential Race

In early November, Donald J. Trump secured victory in the US presidential election, triggering swift movements across global markets, including cryptocurrencies. Bitcoin's price surged by nearly 8% on the news, surpassing $75,000 and setting a new all-time high. Crypto-related stocks, such as Coinbase and MicroStrategy, also saw brief rallies.

The market's positive response stemmed from Trump and his party's numerous pro-crypto promises during his campaign. In June 2024, he endorsed Bitcoin mining, and by July, Senator Cynthia Lummis introduced the BITCOIN Act of 2024, advocating for the US Treasury to acquire 1 million BTC.

For months leading up to the election, the crypto market’s sentiment became deeply intertwined with Trump’s chances of winning. This connection was evident as Bitcoin's price closely mirrored Trump’s odds on prediction platforms like Polymarket.

Figure 4: Bitcoin's price closely mirrored Trump’s election odds in the lead-up to the vote

Source: AMINA Bank, Polymarket, Glassnode

Memes Meet Artificial Intelligence

The year 2024 saw the convergence of two dynamic sectors in crypto - memes and artificial intelligence. Enter AI meme coins: the next evolution of meme coins infused with AI capabilities.

Unlike traditional meme coins that rely solely on community hype and Discord raids, AI meme coins leverage advanced bots to shill, create content and engage directly with holders. These bots go beyond standard webhooks, acting as AI agents capable of influencing markets and fostering vibrant communities. Currently, the sector boasts a market capitalisation of $16 billion, up 39% in just the past week, according to CoinGecko.

The trend began when Terminal of Truth, an AI bot, received a $50,000 grant from a16z’s Marc Andreessen to invest in promising coins on-chain. This sparked the rise of Truth Terminal coins, with Goatseus Maximus (GOAT) leading the pack after its acquisition by the bot propelled it to a market cap in the hundreds of millions.

Innovation extended to other platforms as well. On Base L2, the Virtuals launchpad introduced AI agents, bringing meme coins like LUNA and AIXBT into the spotlight. Meanwhile, Solana had the Eliza framework, enabling the creation of AI agents on-chain. Among its notable successes is AI16Z. Readers interested in diving deeper into Eliza and AI16Z can explore this article.

Conclusion

The year 2024 was a remarkable one for crypto, marked by significant progress in institutional adoption, driven by the launches of US spot Bitcoin and Ether ETFs. At present, public entities, including governments worldwide, hold nearly $285 billion worth of Bitcoin.

Among the year’s milestones, the most iconic was Bitcoin breaking past the $100,000 barrier, even surpassing silver in market capitalisation. This historic achievement underscored the growing legitimacy and mainstream adoption of cryptoassets.

Looking ahead to 2025, the sector is poised for a transformative year. Key developments include the full implementation of the Markets in Crypto Assets (MiCA) regulation and the anticipated launch of new altcoin ETFs, particularly for XRP and SOL. Combined with a pro-crypto US Congress, the stage is set for a thrilling year, packed with opportunities and milestones that could redefine the crypto landscape once again.

Disclaimer

This document is provided by AMINA Bank AG ("AMINA") and is intended for educational and informational purposes. AMINA’s weekly Crypto Market Monitor is not intended for distribution in any jurisdiction where such distribution would be prohibited. Furthermore, it is not aimed at any person or entity residing in such jurisdiction. It does not constitute an offer or a recommendation to subscribe, purchase, sell or hold any security or financial instrument. The document contains the opinions of AMINA as at the date of issue, which do not take into account an individual’s circumstances and objectives. AMINA does not make any representation that any investment or strategy is suitable or appropriate to individual circumstances or that any investment or strategy constitutes personalized investment advice. Some investment products and services may be subject to legal and regulatory restrictions or may not be available worldwide on an unrestricted basis. The information and analysis contained in this Crypto Market Monitor are based on sources considered as reliable. AMINA makes its best efforts to ensure the timeliness, accuracy, and comprehensiveness of the information contained in this document. Nevertheless, all information indicated herein may change without prior notice.

Top Kryptowährungen

- 1T

- 1W

- 1M

- 3M

- 1J

- 3J

| HarryPotterObamaPacMan8Inu | 0.0080 | 9.64% | K | V |

| Department Of Government Efficiency (dogegov.com) | 0.1646 | 8.89% | K | V |

| Algorand | 0.3424 | 7.31% | K | V |

| Filecoin | 4.7454 | 5.36% | K | V |

| Chainlink | 18.5072 | 4.41% | K | V |

| Dogecoin | 0.3230 | 4.38% | K | V |

| Cardano | 0.9009 | 4.16% | K | V |

| 0x | 0.4432 | 3.28% | K | V |

| EOS | 0.7230 | 3.21% | K | V |

| Compound | 68.5690 | 2.79% | K | V |

Inside Krypto

Ob Industrie 4.0, Luxusgüter oder Internet-Infrastruktur - hier finden Sie aktuelle Anlagetrends mit vielen Hintergrundinformationen und passenden Trendaktien. Jetzt mehr lesen

Bitcoin: 150.000 USD Marke im 2025? | BX Swiss TV

Wird Bitcoin die 150.000 USD Marke nächstes Jahr erreichen und was heisst das kürzlich gesehen Allzeithoch für die Branche?

Im heutigen Experteninterview mit David Kunz, COO der BX Swiss spricht Sina Meier, Managing Director bei 2Shares über den Verlauf für Kryptowährungen des Jahres 2024.

Was dabei am besten lief, welche Auswirkungen institutionelle Anleger auf den Markt haben und welche neuen Innovationen man von 21Shares erwarten kann, erfahren Sie im heutigen Experteninterview.

👉🏽 Jetzt auch auf BXplus anmelden und von exklusiven Inhalten rund um Investment & Trading profitieren!