| Kurse + Charts + Realtime | News + Analysen | Fundamental | Unternehmen | zugeh. Wertpapiere | Aktion | |

|---|---|---|---|---|---|---|

| Kurs + Chart | Chart (gross) | News + Adhoc | Bilanz/GuV | Termine | Strukturierte Produkte | Portfolio |

| Times + Sales | Chartvergleich | Analysen | Schätzungen | Profil | Trading-Depot | Watchlist |

| Börsenplätze | Realtime Push | Kursziele | Dividende/GV | |||

| Orderbuch | Analysen | |||||

| Historisch | ||||||

|

08.05.2025 07:29:33

|

EQS-News: GFT Starts 2025 with Solid Growth

|

EQS-News: GFT Technologies SE

/ Key word(s): Quarterly / Interim Statement/Quarter Results

GFT Starts 2025 with Solid Growth Strong Growth in Americas and Insurance Business Confirm Strength of AI-Centric Strategy in Challenging Environment, Five-Year Strategy in Execution

Stuttgart, 8 May 2025 – GFT Technologies SE (GFT) continues to deliver on its five-year strategy, with first-quarter revenue up 4 percent. Strong growth in North and Latin America, APAC and a 24 percent surge in the insurance business confirmed the strength of GFT’s AI-centric setup. A major AI project has taken GFT into the robotics market. Early signs of recovery in Europe and an order backlog increase of 14 percent added further momentum. GFT AI Impact also continued to gain traction: the number of new licenses sold increased from 315 in the previous quarter to 440 in the first quarter of 2025. More than 10,000 GFT engineers have now been trained with the GenAI product, and the first US client has been won. AI Impact boosts software development productivity by 50 to 90 percent. GFT also strengthened its market presence, earning the Google Cloud Country Partner of the Year Award for Germany and two FS Tech Awards – “Best Use of IT in Consumer Finance” and “Financial Services Collaboration of the Year”, and a Fintech Breakthrough Award for “Best Digital Bank”. Another major highlight was that the integration of Sophos Solutions was completed in Q1 – after one year, exactly as planned. GFT’s MSCI ESG rating was also upgraded by two notches to A, underscoring its commitment to sustainable, responsible growth. “We focus on executing our five-year strategy, and our portfolio proves its high resilience. Growth in North America, Latam, APAC and signs of business picking up in Europe show that our AI-centric strategy is successfully setting us apart from our competitors. The same goes for our sector mix: the insurance business has once again turned into a major growth driver for us and we have entered the dynamic robotics sector with a multi-million AI contract which opens up a new frontier for GFT,” said GFT’s Global CEO Marco Santos. He continued: “Where we are confronted with structural challenges, mainly the UK market and at Software Solutions GmbH, we are owning and addressing those challenges with a clear transformational plan, utmost dedication and a long-term view.” The GFT Group generated revenue of EUR 221.91 million in the first three months of 2025. The company thus exceeded the prior-year figure of EUR 212.39 million by 4 percent (on constant currencies +7 percent). GFT achieved growth of 24 percent in the Insurance sector and 12 percent in the Industry & Others sector. Revenue in the Banking business was stable (+0 percent). Dynamic Growth in Americas and APAC, Business in Europe Picking up, Challenges in UK Identified Revenue in the Americas, UK & APAC segment increased by 10 percent compared to the previous year’s period. This includes the acquisition of Sophos Solutions, which is reflected in the group figures with effect from 1 February 2024. The increase was driven by strong growth in Brazil, the USA, Canada and Colombia. Revenue in Latin America grew by 29 percent, in North America by 19 percent, whereas business in the UK was down 20 percent over the previous year. The Continental Europe segment slowed down by 2 percent due to macroeconomic challenges. “There are currently clear challenges for our industry in the European markets, driven by global tariff discussions and recessionary fears. However, our strong pipeline in several countries including the USA serves as an important stabilizer for our overall business outlook,” stated Jochen Ruetz, CFO of GFT. He continued: “We remain vigilant in monitoring these market dynamics while taking confidence in the diversity of our revenue streams. This balanced exposure allows us to maintain our financial targets despite the headwinds we’re experiencing in European markets.” Operating Earnings Impacted by Higher Personnel Costs Adjusted EBIT decreased by 18 percent year-on-year to EUR 15.09 million (Q1/2024: EUR 18.31 million). This decrease was mainly due to additional investments fostering future growth, higher social security contributions, lower R&D subsidies in various markets, and challenges in the UK market and at Software Solutions GmbH. Structural transformational initiatives in order to address both the UK market and Software Solutions GmbH are underway. The adjusted EBIT margin was 6.8 percent in the first three months of 2025 (Q1/2024: 8.6 percent)1). At EUR 10.01 million, EBT has decreased by 33 percent over the same period of the previous year (Q1/2024: EUR 15.00 million). Share Buy-back Program Started Cash flow from operating activities of EUR -4.31 million (Q1/2024: EUR 6.42 million) was impacted by increased amount of funds tied up in working capital, especially in customer receivables – following highly positive effects in the fourth quarter of 2024 from significant payments by major clients. As at 31 March 2025, the group employed a total of 11,413 full-time equivalents (FTEs). This corresponds to a slight decrease of 1 percent compared to 11,506 FTEs at the end of 2024. GFT has decided to buy back up to EUR 15 million worth of its own shares, underscoring the company’s confidence in the new five-year strategy. The share buy-back program via the stock exchange is based on the authorization granted by the Annual General Meeting on 24 June 2020 to purchase treasury shares up to 10 percent of share capital. It began in April 2025 and, subject to renewed authorization by the Annual General Meeting on 5 June 2025, shall end no later than October 14, 2025. Outlook 2025 and Mid-Term Targets 2029 Confirmed: Growth to Continue Although some markets remain challenging, GFT expects further growth in group revenue in the financial year 2025. The company confirmed its guidance for this year. In detail, the company continues to expect revenue growth in 2025 of 7 percent to EUR 930 million. Adjusted EBIT is forecast to decrease by 4 percent to around EUR 75 million. By 2029, GFT aims to generate EUR 1.5 billion in revenues with an adjusted EBIT margin of 9.5 percent. GFT expects continued revenue growth, driven by organic growth and targeted acquisitions in core markets. Ongoing investment in GFT assets will support this trajectory. Profitability is set to rise as the service mix shifts to higher-margin offerings and smartshore delivery expands. A focus on existing markets will drive further scale and efficiency.

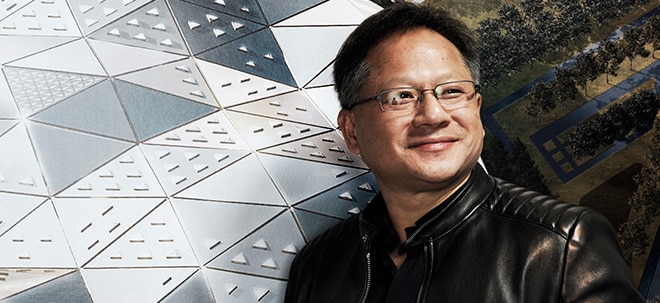

Further information on the definition of alternative performance measures is provided here on the GFT website. Marco Santos, Global CEO of GFT Source: Tom Maurer/GFT This press release is also available for download via the GFT newsroom

About GFT GFT Technologies is a responsible AI-centric global digital transformation company. We deliver advanced Data & AI transformation solutions, modernize technology architectures, and develop next-generation core systems for industry leaders in Banking, Insurance, Manufacturing and Robotics. Partnering closely with our clients, we push boundaries to unlock their full potential. With deep industry expertise, cutting-edge technology, and a strong partner ecosystem, GFT delivers responsible AI-centric solutions that combine engineering excellence, high-performance delivery, and cost efficiency. This makes us a trusted partner for sustainable impact and customer success. Our team of 12,000+ technology experts operate in 20+ countries worldwide, offering career opportunities at the forefront of software innovation. GFT Technologies SE (GFT-XE) is listed in the SDAX index of the German Stock Exchange. Let’s Go Beyond_

08.05.2025 CET/CEST Dissemination of a Corporate News, transmitted by EQS News - a service of EQS Group. |

| Language: | English |

| Company: | GFT Technologies SE |

| Schelmenwasenstraße 34 | |

| 70567 Stuttgart | |

| Germany | |

| Phone: | +49 (0)711/62042-0 |

| Fax: | +49 (0)711/62042-301 |

| E-mail: | ir@gft.com |

| Internet: | www.gft.com |

| ISIN: | DE0005800601 |

| WKN: | 580060 |

| Indices: | SDAX |

| Listed: | Regulated Market in Frankfurt (Prime Standard); Regulated Unofficial Market in Berlin, Dusseldorf, Hamburg, Hanover, Munich, Stuttgart, Tradegate Exchange |

| EQS News ID: | 2132668 |

| End of News | EQS News Service |

|

|

2132668 08.05.2025 CET/CEST

Nachrichten zu GFT SE

|

17:58 |

Donnerstagshandel in Frankfurt: SDAX präsentiert sich letztendlich schwächer (finanzen.ch) | |

|

15:58 |

Börse Frankfurt in Rot: SDAX verbucht am Donnerstagnachmittag Verluste (finanzen.ch) | |

|

09:28 |

Zurückhaltung in Frankfurt: SDAX liegt zum Handelsstart im Minus (finanzen.ch) | |

|

17.06.25 |

XETRA-Handel SDAX fällt zum Start zurück (finanzen.ch) | |

|

16.06.25 |

EQS-CMS: Share buyback / Announcement pursuant to Art. 5 para. 1 lit. b), para. 3 of Regulation (EU) No 596/2014 and Art. 2 para. 2 and para. 3 of Delegated Regulation (EU) No 2016/1052 (EQS Group) | |

|

16.06.25 |

XETRA-Handel: SDAX letztendlich fester (finanzen.ch) | |

|

16.06.25 |

Börse Frankfurt in Grün: Das macht der SDAX nachmittags (finanzen.ch) | |

|

16.06.25 |

Starker Wochentag in Frankfurt: SDAX-Börsianer greifen zu (finanzen.ch) |

Was passiert, wenn ein schlankes Fintech mit einer klaren Mission den Schweizer Vorsorgemarkt aufrollt?

Im aktuellen BX Morningcalls begrüssen wir Beat Bühlmann, Präsident des Verwaltungsrates von finpension – einem spannenden Fintechs im Schweizer Vorsorgemarkt.

Seit seiner Gründung 2016 hat finpension ein beeindruckendes Wachstum hingelegt: Über 3 Milliarden Franken verwaltetes Vermögen, mehr als 35’000 Kunden – und das mit einem kleinen, hochspezialisierten Team.

Doch was steckt wirklich hinter dieser Erfolgsstory? Und wohin geht die Reise?

Im Gespräch mit François Bloch und Olivia Hähnel (BX Swiss) erklärt Beat Bühlmann, warum traditionelle Banken unter Druck geraten, wie man mit nur 1 Franken in Private Equity investieren kann – und weshalb Technologie, Transparenz und Unabhängigkeit die Säulen moderner Vorsorge sein müssen.

👉🏽 https://bxplus.ch/bx-musterportfolio/

Inside Trading & Investment

Mini-Futures auf SMI

Inside Fonds

Meistgelesene Nachrichten

Top-Rankings

Börse aktuell - Live Ticker

Sorge um mögliche Eskalation des Nahostkrieges: SMI nach SNB-Zinsentscheid im Minus -- DAX leichter -- US-Börsen mit Feiertagspause -- Asiens Börsen schliessen schwachDer heimische und der deutsche Aktienmarkt fuhren am Donnerstag Verluste ein. Die wichtigsten Börsen in Asien gaben am Donnerstag klar nach. In den USA wird am Donnerstag aufgrund eines Feiertages nicht gehandelt.

finanzen.net News

| Datum | Titel |

|---|---|

|

{{ARTIKEL.NEWS.HEAD.DATUM | date : "HH:mm" }}

|

{{ARTIKEL.NEWS.BODY.TITEL}} |